What actuarial exams do you have to take to become a qualified actuary? Actuarial qualifications are rigorous, so it is good to get an idea of the type of exams you will be taking.

The actuarial syllabus is reviewed and updated every year. The syllabus and examinations described below cover the full range of study required up to Associateship and Fellowship levels.

Curriculum

The employment opportunities available for those with an actuarial skill set continue to develop and grow, in some cases outside the traditional areas.

The IFoA has made every effort to ensure the curriculum is relevant, up-to-date, and reflects the skills, knowledge and attributes required of an actuary. Examination content is influenced by actuarial research, industry needs and global business requirements.

The core subjects also align to the 2017 International Actuarial Association (IAA) syllabus, and meets international standards.

Core reading and sample examination papers for the Curriculum are available at actuaries.org.uk/curriculum

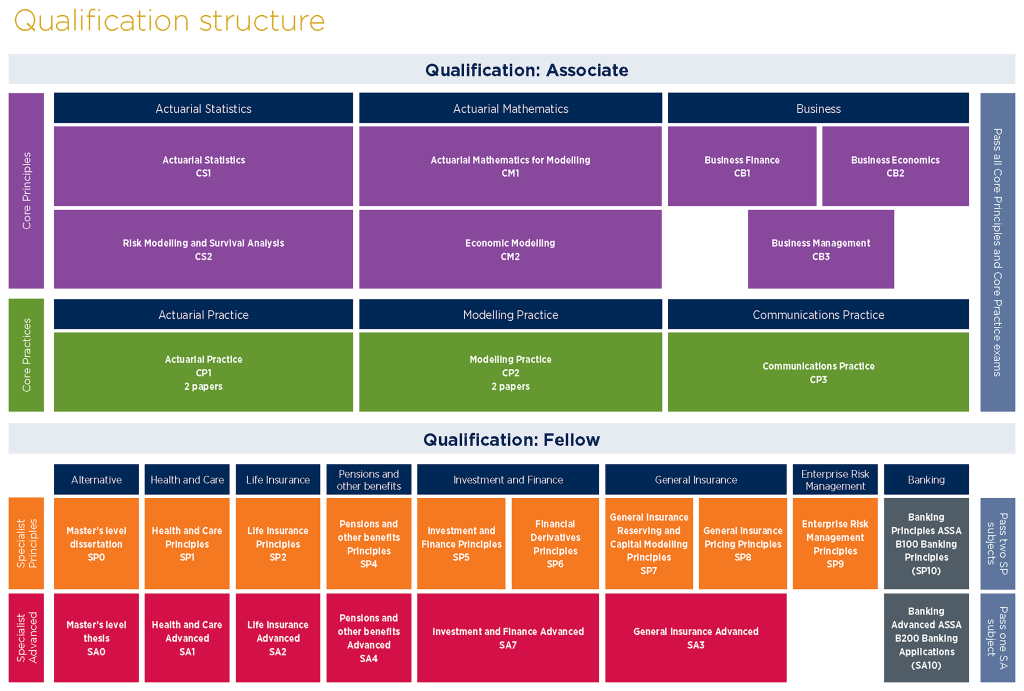

To qualify as an Associate, you will be required to complete, or have been granted exemption(s) from the following examinations:

- Core Principles

- Actuarial Statistics

- Actuarial Mathematics

- Business

- Core Practices

- Actuarial Practice

- Modelling Practice

- Communications Practice

To qualify as a Fellow, you will be required to complete, or have been granted exemption(s) from the following examinations:

- Specialist Principles

- Specialist Advanced

Subjects covered

Core Principles

- Actuarial Statistics – The strength of our Actuarial Statistics subjects is the emphasis on understanding statistical concepts and methods, and their practical application to actuarial problems. In both CS1 and CS2, emphasis is placed on being able to apply statistical methods to actuarial problems using real data sets and the open-source software environment R. In designing these new subjects will enhance Actuarial Science for our student members through the development of transferable skills and enhanced employability.

- Actuarial Mathematics – Actuarial Mathematics forms the core for classical actuarial expertise. The design of the new subject modules, Actuarial Mathematics for Modelling (CM1) and Economic Modelling (CM2) provides students with core reading material containing essential knowledge on areas such as how to price different financial products, such as bonds, and insurance products, such as life insurance.

- Business – The Business subjects provide a comprehensive introduction to the core practice areas of Business Finance (CB1), Business Economics (CB2) and Business Management (CB3) in an international and global context. Through the core reading and reference texts students have the opportunity to explore a range of business topics within an actuarial context.

Core Practices subjects

- Actuarial Practice – The aim of Actuarial Practice is to use the technical and business skill learnt in the Actuarial Statistics, Actuarial Mathematics and Business subjects combining them with new material on how the skills are applied to solve real world problems. The material provides the essential knowledge of risk management techniques and processes required by all actuaries and is an essential introduction to Enterprise Risk Management, subject SP9 and the Chartered Enterprise Risk Actuary qualification.

- Modelling Practice – The Modelling Practice (CP2) subject provides actuaries with more ‘rounded’ skills with regards to communicating and presenting spreadsheet work in a business context. The subject builds on the technical material covered in all the earlier subjects. The aim of Modelling Practice (CP2) is to develop a student’s ability to model data, document the work (including maintaining an audit trail for a fellow student and senior actuary), analyse the methods used and outputs generated and communicate to a senior actuary the approach, results and conclusions.

- Communications Practice – The aim of Communications Practice (CP3) is to ensure that actuaries can communicate effectively when relating concepts used by actuaries to recipients without technical expertise and that they can undertake an element of self-reflection in their communication. It builds on material covered in subject CP1 which in turn builds on some of the tools taught in the earlier subjects.

Specialist Principles subjects

To progress to Fellow membership, you will need to pass two of the subjects below to demonstrate your understanding of the concepts in your chosen subjects and application of principles to the various sectors.

- Alternative

- Health and Care

- Life Insurance

- Pensions and Other Benefits

- Investment and Finance

- General Insurance

- Enterprise Risk Management

- Banking

Specialist Advanced subjects

The Specialist Advanced subjects require you to pass one of these subjects below, to show that you can apply principles of actuarial practice to an advanced area.

- Alternative

- Health and Care

- Life Insurance

- Pensions and Other Benefits

- Investment and Finance

- General Insurance

- Banking

For more about the different topics covered in the syllabus, visit online at actuaries.org.uk/curriculum

Options for Research

If you continue studying to become a fellow, you can opt to conduct original research as an alternative to taking one of the IFoA’s Specialist Advanced exams.

Your research must involve an actuarial approach to problem solving, and make an original contribution to actuarial science. The dissertation must demonstrate how the work links to relevant actuarial knowledge.

The research is expected to be at MPhil or research degree level and takes at least two years of part-time study.