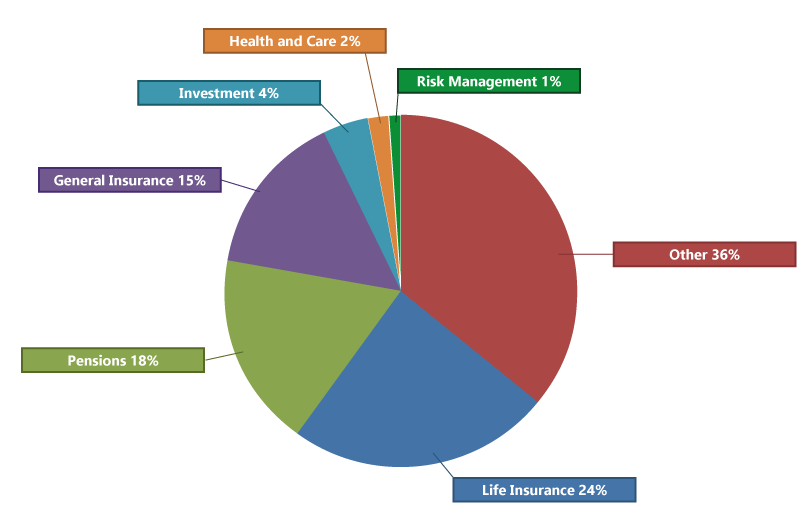

While actuaries have historically been employed by the insurance industry, today they work in a variety of industries all over the world. Whether it’s in traditional fields such as insurance and pensions or emerging fields like climate change, actuaries analyse the challenges of today to prepare for the risks of tomorrow.

Actuaries tackle the risks and uncertainties that financial businesses face, working in the interest of both customers and owners.

The range of opportunities for a qualified actuary is always growing especially as actuarial skills are becoming increasingly recognised across industries.

Some of the traditional areas include pensions, insurance and investment.

However, there are now growing areas relating to cyber risk, data science and systems thinking where actuaries are making an impact.

There are currently over 30,000 members of the Institute and Faculty of Actuaries (IFoA), with 72% based in the UK and Northern Ireland and 28% based elsewhere.

Find out more about each field of work, as well as emerging fields, below.

Life Insurance

Working in companies that provide life insurance, pensions and other financial services is a traditional area for actuaries. They are involved at all stages of the product development, pricing, risk assessment and marketing of the products.

To find out more about working in Life Insurance, read our article here.

Pensions

Actuaries are heavily involved in designing and advising on occupational pension schemes. From formal evaluations for one person’s benefit to a whole scheme with one million members, actuaries are invaluable to the pensions industry.

Discover more about the Pensions work sector here.

General Insurance

General insurance includes personal insurance, such as home and motor insurance, as well as insurance for large commercial risks, and general insurance companies will employ actuaries to assist with their financial management. You can also find roles in reinsurance and broking operations.

Read our article on General Insurance here to find out more about this area of work.

Finance and Investment

Investment Management

For decades, actuaries have been involved in investment management. They are involved in buying and selling assets, investment analysis and portfolio management. In addition, actuarial techniques are ideal for use in measuring investment performance.

Corporate Finance

While this area of finance is often regarded as the province of the investment banker, actuaries can really add value in this area.

Banking

As an increasing number of insurance companies have their own banking operations, demand for actuaries in the banking field is growing and many actuaries are now filling some of the senior roles in finance and risk. Actuaries are also found in retail banks as many are recognising that the longer term approaches advocated by actuarial professionals can add value to their business.

Find out more about Finance and Investment here.

Risk Management

An actuary’s aptitude for analysing specific risks make them well suited to work in risk management.

They develop models that they can leave with a business to minimise their own future risks. An actuary will then have to explain the model well enough to the business so they can use it to full effect. Therefore, the ability to convey complex information in layperson’s terms is vital in this role. Find out more about the Risk Management practice area here.

Emerging Fields

Whether it’s the impact of new technology or the consequences of a rapidly changing world, businesses are facing challenges they have never encountered before. As experts in risk, actuaries are expanding into new areas of practice that support businesses as they prepare for an uncertain future. These include areas related to Data Science, Cyber Security and Climate Change.